Table of Contents

Choosing the correct business planning software and invoicing tools is essential for managing your financial data, overseeing company assets, handling accounting tasks, and predicting financial outcomes both in the short and long term.

The marketplace for small business accounting solutions is filled with many options, each packed with features suitable for various business sizes and platforms. By 2026, estimates suggest the global accounting software industry will reach a value of about $11,772 million.

This expanding market creates a challenge: with so many options at your fingertips, identifying and selecting the right financial software tailored to your business needs can become complicated. While numerous high-quality programs are available, choosing one that provides the necessary tools can be overwhelming.

Among the most popular choices are Quicken and QuickBooks. Both platforms are designed to assist small businesses in tracking their financial activities effectively. This article will compare their features across various aspects such as expense reporting, budgeting, invoicing, recurring payments, inventory management, cash flow optimization, and more.

Let’s take a closer look at these two tools.

Overview of Quicken vs. QuickBooks

Here’s a brief summary of what each software offers:

Quicken:

Quicken is a financial management tool owned by H.I.G Capital, mainly aimed at personal finance management. It consolidates all your financial accounts into one platform, empowering you to make strategic decisions aligned with your financial goals.

It excels at managing personal income and expenses, offering additional features such as bill reminders, investment tools, tax tips, and more. A key feature is its capability to manage real estate properties, lease details, and rental income. The software is compatible with both Mac and Windows operating systems, ensuring versatility regardless of your setup.

QuickBooks:

QuickBooks is developed by Intuit and is designed primarily for small business accounting needs. It helps users track income, expenses, and employee details efficiently.

QuickBooks offers comprehensive tools such as transaction entry, bank reconciliation, financial reporting, payroll processing, and investment management, supporting small business owners in efficiently managing their finances.

Here's a quick comparison of Quicken and QuickBooks:

| Quicken | QuickBooks | |

|---|---|---|

| G2 Score | 4.2 | 4 |

| Ideal For | Rental property owners, freelancers, and individuals managing personal finances. | Small business owners, including sole proprietors. |

| Starting Price | $35.99/year | $25/month |

| Cloud-Based | No | Yes |

| Financial Statement Generation | Yes | Yes |

| Inventory Management | No | Yes |

| Payroll Features | No | Yes |

| Specialty Features | Property and rental income management tools | Transaction tracking, payroll, and investment management |

| Category | Availability for Android & iOS | Availability for Android & iOS |

|---|---|---|

| Mobile App | Yes | Yes |

| Double-Entry Bookkeeping | No | Yes |

| Access for Accountants | No | Yes |

| Project Profitability Monitoring | Yes | Yes |

| Invoicing Capabilities | Yes | Yes |

| 1099 Contractor Management | No | Yes |

| Customer Support | Phone and email | Phone and email |

Now, let’s explore in detail which accounting software is the best choice for small businesses in the Quicken vs. QuickBooks comparison.

Quicken vs. QuickBooks: An In-Depth Comparison

Although Quicken and QuickBooks share some similarities, key differences may make one a better fit for your business needs than the other.

Below is a comprehensive comparison of these popular accounting solutions to help you decide which one suits your business best.

Learn more about the top small business accounting software of 2025.

1. Expense Management

Effective expense management is crucial, whether you’re aiming to eliminate debt, save for future goals, or pay down a mortgage. Tracking your expenses helps you see exactly where every dollar goes.

Let’s see how Quicken and QuickBooks compare in this area.

Quicken:

Quicken requests all your account details right after signing up, including bank accounts and investments. It tracks all transactions to provide a clear picture of your expenses and overall financial health.

It analyzes recent transactions, categorizes spending (such as Home, Education, Business), and displays your net income, spending patterns over time, and more. This detailed insight helps you understand where your money is going.

Quicken also generates reminders for bills and income, helping you stay on top of payments. For rental property owners, it offers graphs that summarize rental income and expenses, including categories like top expenses and income versus expenses over time.

A standout feature is its monthly income and expense forecasting, which helps prevent overspending by projecting future cash flows based on historical data. You can also categorize transactions by household members, customize expense categories, and analyze monthly spending trends.

Additionally, Quicken protects you from online fraud by enabling you to flag suspicious transactions. With integration with over 14,000 financial institutions, you can view all your financial data on a single dashboard across desktop, mobile, or web platforms for maximum convenience.

QuickBooks:

While Quicken mainly caters to freelancers, personal finances, and rental businesses, QuickBooks is geared more towards small businesses with more advanced needs.

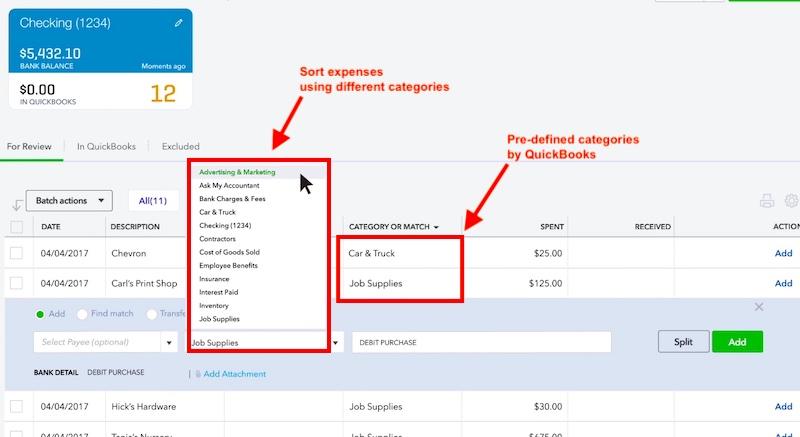

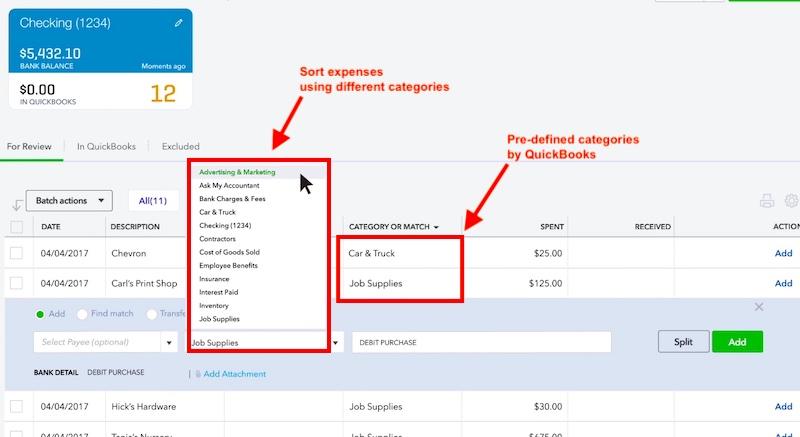

Start by linking your QuickBooks account to various financial sources—your bank accounts, PayPal, Square, credit cards, and more. The software automatically imports all income and expenses, simplifying your bookkeeping.

Once transactions are imported, you can approve, edit, or create custom rules for automatic categorization, ensuring your financial data is accurate and organized. This streamlines your expense management process and helps maintain clear records for tax and analysis purposes.

To simplify complex paperwork, users can take photos of receipts and bills using the mobile app and save them directly.

QuickBooks automatically matches the details from your receipt to an existing transaction in your account, storing the information for future reference. This feature makes expense management straightforward and stress-free. Their scanner extracts crucial information like the vendor’s name, receipt date, total amount, and payment method directly from the image, automatically associating the data with your current expenses or creating new entries as needed.

Additionally, QuickBooks offers a project management feature that helps categorise all your projects and track the expenses associated with each one. Through built-in reports, you can monitor your expenses, income, and unpaid invoices. There’s also an option to share your expense reports directly with your accountant from the dashboard, and access profit and loss statements to see where most of your business money is being spent.

QuickBooks stands out due to its comprehensive receipt management, bill data extraction, project tracking, and user-friendly reporting features. Its interface and reporting tools are more intuitive and easier to navigate compared to Quicken. While Quicken is better suited for managing rental properties and personal expenses, QuickBooks excels in business expense tracking and project management.Quicken’s Simplifi mobile app allows you to exclude irregular income and one-time transactions from your monthly budget plan. This includes expenses such as lottery tickets, gifts, and similar irregular costs.

It also uses advanced machine learning to suggest budget amounts, based on your past spending and earning patterns.

Other essential budgeting features include:

- The option to set aside funds for savings goals.

- The ability to roll over unused budget amounts into future periods.

- Transferring budgeted funds between different accounts.

- Budgeting based on calendar or fiscal years.

- Creating annual budgets alongside monthly plans.

- Monitoring savings, paying credit card dues, mortgages, and other bills.

You can also set up distinct budgets for different members of your family, small businesses, clubs, and other groups.

The app offers more sophisticated tools to help manage and track your business tax deductions, as well as profit and loss statements, but these features are only available with the higher-priced plans.

QuickBooks:

QuickBooks supports the creation of business budgets rooted in your accounting data. It offers the flexibility to modify, duplicate, or remove existing budgets as needed.

A Budgets vs. Actuals report feature enables you to compare your real expenses and revenue against your set budget. This comparison can be done quarterly or annually, aiding in financial analysis.

In QuickBooks, budgeting also encompasses metrics such as average order value, monthly order volume, material costs, rent, utilities, mortgage payments, average payroll expenses, and billable hours.

Winner: Quicken. Since Quicken is primarily designed for personal finance management, it provides more comprehensive options for managing personal budgets and tracking individual expenses compared to QuickBooks.

3. Invoicing.

Quicken:

With Quicken, you can send invoices directly to clients, but this feature is only available with the Quicken Home and Business plan. You can also attach a PDF copy of the invoice to your email.

While the interface may seem somewhat outdated, you can customize the header color and alternate row colors within the invoice layout editor. You can include or remove sections such as title, date, invoice number, item list, and description.

Additionally, you can upload your company’s logo, address, and other details directly into invoices using the built-in editor.

This covers the invoicing abilities of Quicken. It’s suitable for sending standard invoices, but its features aren’t extensive enough for comprehensive invoicing needs.

QuickBooks:

QuickBooks provides robust tools for creating, managing, printing, and emailing an unlimited number of invoices. It’s ideal for those seeking professional-grade invoicing solutions.

It includes a variety of pre-designed invoice templates that you can customize extensively using built-in design tools or create your own from scratch.

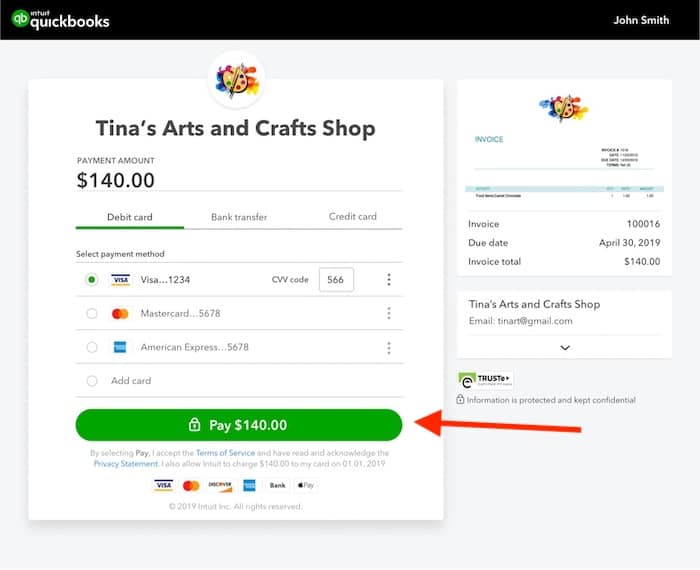

The platform also enables adding payment buttons to invoices, allowing customers to pay with a single click.

Customers can accept payments via credit cards, debit cards, or ACH transfers, making transactions seamless. The platform also supports scheduling and sending recurring invoices through email, with automated reminders sent to clients. You can easily monitor invoice statuses—whether pending, viewed, paid, sent, or deposited—using the invoice tracking feature.

Winner: QuickBooks. While Quicken allows basic invoicing, QuickBooks offers comprehensive and professional invoicing services suitable for larger or more complex businesses.

4. Recurring and Automated Bill Payments.

Managing numerous bills, transactions, and accounts can become overwhelming. Fortunately, both Quicken and QuickBooks enable setting up recurring payments, simplifying collection processes and enhancing cash flow stability.

Let’s analyze how each tool handles this feature.

Quicken:

Quicken’s automatic payment feature allows you to collect payments from your customers without manual intervention. You specify the start date and the frequency of payments, and invoices are sent automatically. The system also sends automatic reminders to customers about unpaid invoices.

QuickBooks:

QuickBooks offers similar automated recurring payment functionalities. It notifies you when customers view or complete payments on invoices.

QuickBooks offers two main types of recurring payment options:

- Fixed recurring payments – Enables you to set up regular payments with predetermined amounts and intervals.

Collecting payments from customers can be done on a specific date or after a certain period. For example, you might collect subscription fees for newspapers or magazines. Additionally, there’s a feature called variable recurring payments, which allows you to gather irregular or variable payments based on the services your customers use, such as electricity bills. You can also schedule invoices to be sent before their due date to remind customers ahead of time.

Setting up automated payments helps prevent late payments and eases your workload.

Winner: It’s a tie.

5. Inventory Tracking

Quicken’s “Business and Home” plan offers some tools for managing finances related to your home-based business, but it doesn’t include advanced inventory management features. If your inventory is simple and small, you might manually track stock levels. However, for more complex needs, QuickBooks provides comprehensive inventory tracking software. This system automatically updates quantities as you purchase or sell products, helps organize items with images, categories, prices, SKU codes, and more. It enables you to track all products, get alerts for restocking, and understand sales patterns.

You can organize vendor and product details in one place, making reordering easier. With custom reports, you can analyze sales, identify top-selling items, calculate average costs, and monitor inventory value in real time. Key inventory features in QuickBooks include multi-channel tracking, purchase order management, barcode scanning, stock reports, location tracking, inventory accounting, stock adjustments, and detailed restocking logs.

Furthermore, QuickBooks integrates a built-in point of sale system that automatically updates stock levels, ensuring you always know when to reorder.

Winner: QuickBooks.

6. Cashflow Management

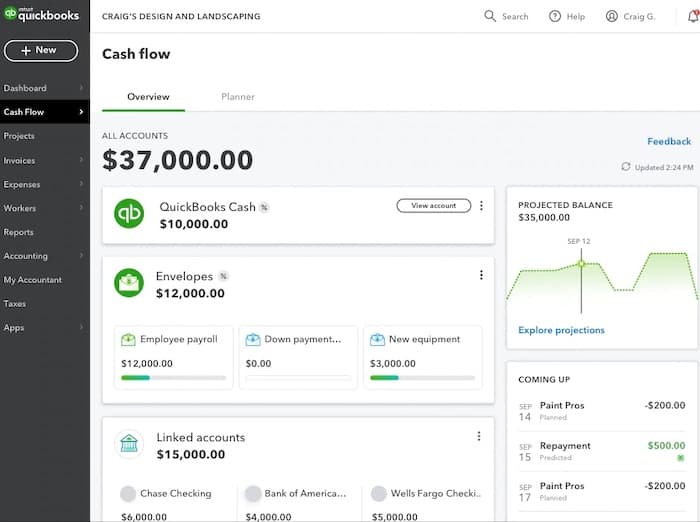

Quicken’s tools for managing cash flow help you understand how much money is entering or leaving your bank accounts. By adding your accounts, bills, and income timelines to the dashboard, you receive notifications about upcoming due bills. It also provides projected balance graphs, such as the Quicken Projected Balances graph, which forecast your future financial position. The system generates reports with interactive graphs, including pie and line charts, breaking down expenses into categories like groceries, rent, or loans, to help you visualize your cash flow.

QuickBooks similarly offers insights into your company’s incoming and outgoing funds through a dashboard that presents your complete financial overview. It includes visual reports like cash flow graphs and balances, giving you a clear picture of your financial health.

QuickBooks features a Payment Predictor that estimates when your customer invoices might be paid. It also provides projections of tax liabilities to help you plan for outgoing payments ahead of time.

Additionally, it alerts you about upcoming bills and offers insights into the expected cash flow before the due date. The software can even forecast your business’s financial outlook for up to a year. Integrate it with your bank accounts to ensure you don’t miss any payments or payroll deadlines. With options like Desktop Premier, Accountant, or Enterprise plans, you can generate financial forecasts based on current or previous year’s data to predict future revenue and cash flow.

Winner: QuickBooks. Both Quicken and QuickBooks allow for account balance predictions and detailed cash flow reporting. However, QuickBooks reports tend to be more user-friendly and straightforward to understand.

7. Managing Payroll

Payroll management is a regulated process essential for paying employees and deducting taxes accurately. Let’s explore how each software handles this.

Quicken:

Quicken does not include payroll management features. While it allows you to track and manage paychecks, it doesn’t provide tools specifically for processing employee wages or handling payroll taxes.

QuickBooks:

QuickBooks offers a comprehensive payroll system that includes HR support and benefits management. You can automate payments by setting recurring payroll schedules for different employees, making the process seamless. It also provides automatic tax calculations, filing services, bookkeeping support, access to expert help, tutorials, and options for retirement plans such as 401(k). You can initiate payroll either directly from the dashboard or through consultation with a payroll specialist. When payday arrives, simply review and approve hours and wages, with taxes already calculated. The software ensures your payroll taxes are calculated, filed, and paid on your behalf, simplifying compliance.

Their team assists in resolving payroll-related tax notices and errors that might occur after you start using QuickBooks payroll services. You’re protected against tax penalties up to $25,000 annually by their penalty insurance coverage. You can also access detailed reports on payroll transactions, project hours, overtime, and more. By syncing QuickBooks online payroll with timesheets, employee clock-ins can be tracked from anywhere, with hours updated automatically. It also provides tools to monitor the time employees spend on specific tasks.

Winner: QuickBooks.

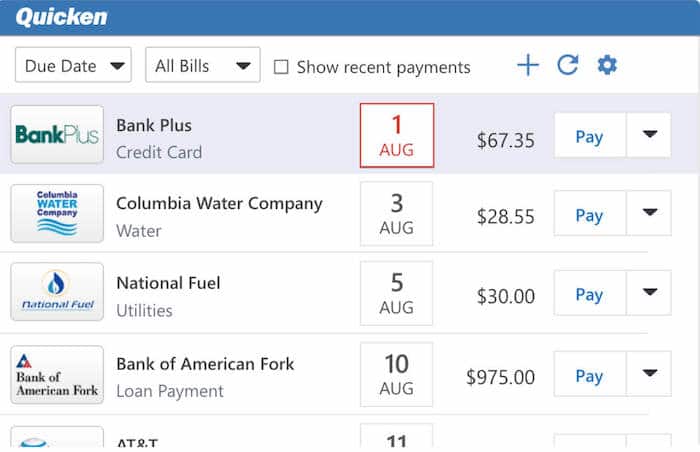

8. Bill Tracking and Payments

Quicken:

Quicken includes a bill pay feature and bill management system that helps you monitor, download, and settle your bills. You can view all upcoming and paid bills on a unified dashboard, with PDF statements available for review.

You can pay bills directly through Quicken by either using its Quick Pay option for electronic transactions or Check Pay for sending checks to billers who do not accept online payments. The Quick Pay method allows for quick electronic payments, while Check Pay involves Quicken sending checks on your behalf without printing them, but only available for U.S. residents with valid addresses. Quicken’s bill tracker consolidates all your bills into one visual, providing alerts for upcoming payments and completed bills.

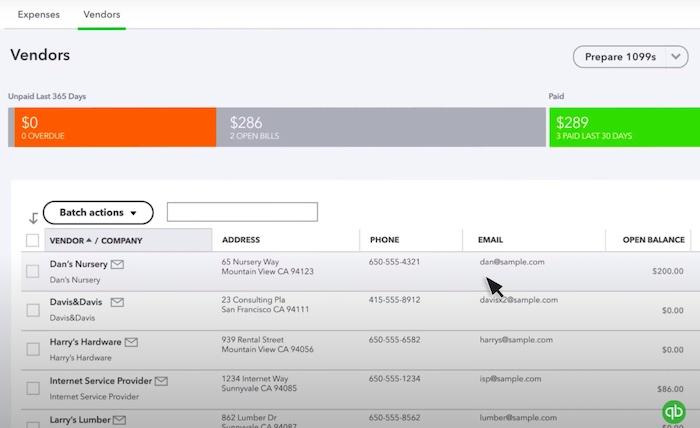

QuickBooks:

QuickBooks features an integrated bill management tool called Bill Pay, available with its higher-tier plans such as QuickPay Essentials, Plus, and Advanced.

Our tool helps you easily add, pay, monitor, and organize your bills. You can also attach a PDF copy of the bill if you have it handy. The feature called Bill Pay seamlessly syncs with QuickBooks, eliminating the need for manual data entry. You’ll gain access to a comprehensive view of all your bills listed by vendor.

The Payment Tracking Feature offers estimated delivery dates, remittance details, and proof of payment once a transaction is successfully completed. When managing payable bills, you can opt to pay online through QuickBooks or send a physical check. The platform supports ACH and international payments in USD at lower wire transfer fees than most banks, as well as local currency transactions with no additional wire charges. You can also access Bill Pay via the QuickBooks mobile app. In the end, the choice of payment method is a tie.

9. Mobile Application.

Quicken Mobile App:

Available for iPhone, iPod touch, iPad with iOS 9 or higher, and Android devices running Android 4.1 or newer, Quicken’s mobile app keeps your finances accessible wherever you go. You can log transactions, store receipts, and synchronize all your data automatically. It also enables tracking of your account balances, expenses, income, and transactions. Visualization features include easy-to-understand graphs for spending analysis, and you can monitor your investment performance with up-to-date updates. Security is a priority, with features like passcodes, 256-bit encryption, and biometric authentication options such as Face ID and Touch ID.

QuickBooks Mobile App:

This app, compatible with Android and iOS devices, allows you to manage your business on the go. It simplifies tasks like creating, sending, and tracking invoices, viewing customer details, capturing receipts, and accessing profit-loss reports and charts. You can also view account balances, generate expense reports, and open invoices directly from your mobile device. Additionally, you can record and categorize expenses, which simplifies tax filing. The app even integrates with smart devices such as the Apple Watch, providing convenient access to your business health metrics. Overall, this feature is a tie.

10. Reporting Capabilities.

Quicken Reports:

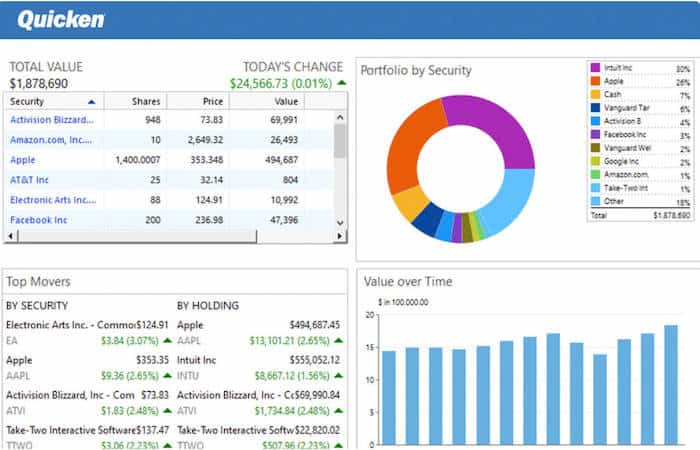

Quicken includes a variety of built-in reports that give insights into your financial management trends. These reports present overviews of spending, income, expenses, and cash flow, assisting in better future planning. They also highlight areas where savings can be made and help manage your taxes effectively. Furthermore, you can track your net worth, investment performance, and portfolio results. Quicken provides nine distinct report types: account balances and net worth, banking summaries, cash flow, transaction histories, spending comparisons, tax reports, investment analyses, business financials, and rental property reports.

For example, Quicken’s investment reports offer detailed insights into your asset allocation, portfolio performance, and investment income, providing a clear picture of your financial standing.

You can tailor your reports to include specific date ranges, categories, expense types, income sources, and more for detailed financial analysis.

QuickBooks offers valuable real-time insights for small businesses through comprehensive reports like income statements and balance sheets directly accessible on its dashboard. You also get a cash flow statement that helps monitor income and expenses, giving a clear picture of your financial health.

Other available reports include comparisons of income from previous years, profit and loss statements, top customer reports, customer balance summaries, accounts receivable aging summaries, and detailed expense reports. Additional reports cover sales, vendors, inventory, purchases, banking, employee data, and payroll details. All of these reports feature interactive graphs and line-by-line transaction details, making data easy to interpret. You can further customize these reports with filters such as transaction type, categories, dates, and income sources. An advanced search function allows you to locate any specific transaction quickly.

Overall, both platforms offer robust reporting features, making it a close call—it’s a tie.

Quicken and QuickBooks also differ significantly in pricing options.

Quicken presents four plans designed to fit various business needs:

– Quicken Starter at $35.99 annually includes basic budgeting, bill management, and simple reports like banking, net worth, and spending analysis with customizable income and expense categories.

– Quicken Deluxe at $51.99 per year adds features such as savings goals, what-if analysis, fiscal year budgets, and tracking of income, debts, mortgages, and investments. It also provides investment reports and fundamental property management tools.

– Quicken Premier at $77.99 annually offers premium support, home value updates via Zillow, same-day online payments, check payments within the US, advanced investment features, and detailed tax reports.

– Quicken Home & Business at $103.99 per year combines all Premier features with additional business-specific reports for managing rental properties and business finances.

Quicken also offers a mobile and web app called Simplify at $35.99 per year, along with a 30-day free trial and discounts—40% off on Deluxe, Premier, and Home & Business plans, and 50% off on Simplifi. A 30-day money-back guarantee is provided for new users.

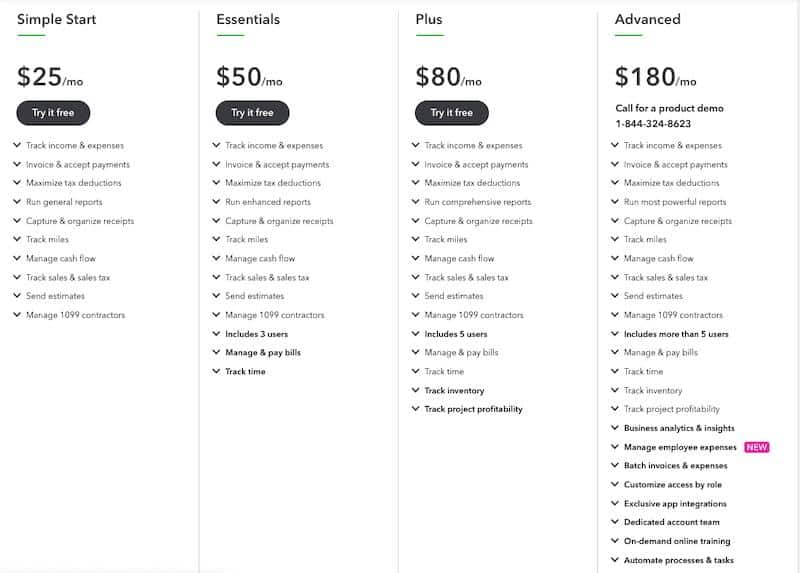

QuickBooks offers four different subscription plans:

– Simple Start at $25 monthly includes core features such as expense and income tracking, invoicing, payment processing, sales tax, and cash flow management, suitable for small operations managing up to 1099 contractors.

– Essentials at $50 per month expands on Simple Start with support for up to three users, time tracking, and bill management.

– Plus at $80 monthly introduces inventory tracking, project profitability analysis, and allows five users.

– Advanced at $180 per month is designed for larger teams, offering more than five users, business insights, employee expense management, automation, and data restoration features.

Both platforms provide flexible, tiered pricing tailored to different business sizes and needs.

The Freelancer plan is also available, ideal for individual users.

QuickBooks Self-Employed offers a monthly subscription at $15. This plan provides tools for tracking income and expenses, generating basic reports, organizing receipts, estimating quarterly taxes, and more. QuickBooks also offers a 30-day free trial along with a special promotion of 50% off for the first three months.

Summary of Key Points

Both QuickBooks and Quicken are robust accounting programs, each offering a wide range of features and integrations. Choosing the right one depends on your unique financial management needs and goals. Quicken is tailored for personal finance, helping users manage personal budgets, investments, and rental property earnings, and comes with a risk-free 30-day trial.

Consider Quicken if you: need personal accounting software, manage investments, track rental income, handle taxes, are a freelancer or self-employed, or seek an affordable, simple solution. Conversely, if you’re a small business owner expecting significant growth, QuickBooks is likely a better fit. It excels in managing business accounts, tracking income and expenses, and handling more complex financial tasks.

Use QuickBooks if you: want to monitor business profits, utilize features like inventory management and payroll, generate invoices, organize bills and receipts, collaborate with an accountant, or manage contractors with 1099 forms. Ultimately, QuickBooks is a comprehensive small business accounting package, while Quicken is geared towards personal finances and rental property management.

Start with QuickBooks because transferring data from QuickBooks to Quicken isn’t straightforward, and switching from Quicken to QuickBooks can be complicated. Make your choice wisely.

For more insights on financial software options, visit StepThroughThePortal.com. Explore comparative reviews such as Xero vs. QuickBooks to find the best fit for your business needs in 2025.